Billings/Accounts Receivable

Everything you do for a client is billed by adding an invoice into Accounts Receivable. Clients can be billed for anything you do -- whether you’re billing an estimate, an advance, a retainer, a service charge, or a job’s final costs.

Clients & Profits provides an innovative feature that can dramatically simplify your billing, called auto-billing, Auto-billing creates invoices automatically for all of your unbilled jobs.

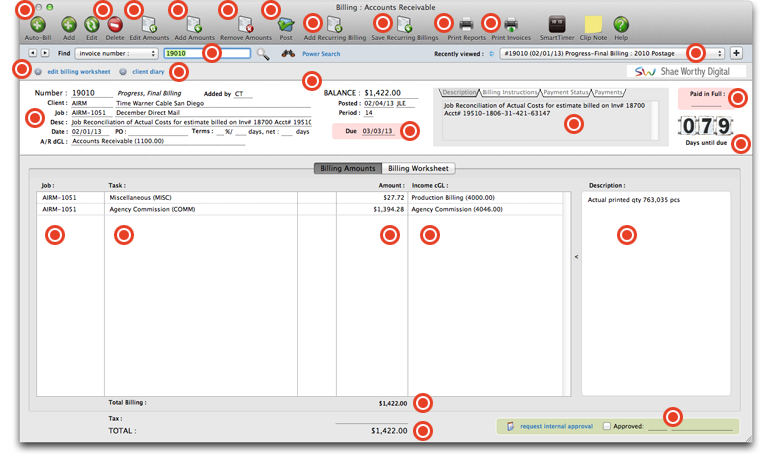

Click these buttons to add, edit, or delete invoices. Step-by-step instructions on adding and editing invoices can be found below.

Billing line items contain the real details about an invoice. Almost everything about an invoice line item can be changed until the invoice is posted. Step-by-step instructions can be found below.

Each billing amount makes a separate journal entry in the General Ledger. Each line item credits an income account, such as Creative Fees, based on the job task’s cGL. For instructions on adding line items, see below.

Removing a billing amount is permanent. Line items can be removed only from unposted invoices. Once removed, however, the same task can be added again, if needed. Invoices need billing amounts just like job tickets needs tasks.

Posting a client invoice updates job tickets, job tasks, the client account, and the General Ledger. When invoices are added, they are unposted. Posting is a methodical process that updates clients, jobs and tasks, and the G/L.

Job billing for routine monthly charges like retainers, web hosting, account management fees, and more can be scheduled then automatically added into Accounts Receivable as unposted invoices. Recurring billings can be a real time saver.

Click this button to save recurring billings.

To print A/R reports, click this button.

Click this button to print the currently selected invoice.

To see recently viewed invoices, use this drop-down menu. C&P will bookmark the last 15 recently viewed invoices, making it easier for you to access invoices without having to search.

To find an invoice, enter the invoice number then click the magnifying glass. If you do not know the invoice number, click the power search link to find A/R invoices by client, job, etc.

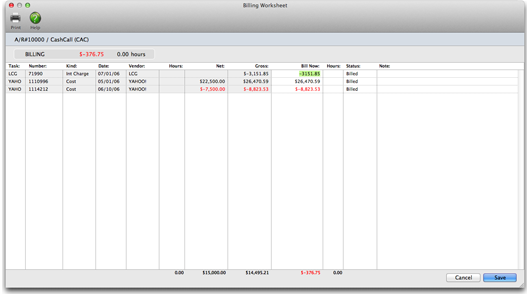

Click here to edit the billing worksheet. Editing the Billing Worksheet has no direct effect on your General Ledger. That’s because costs update the General Ledger when they are posted as accounts payable and checks.

The Client Diary lists all of the entries users have made about interacting with the client, whether it is a phone call or just a note (a diary entry) about something that is going on. The information here provides a recorded history of your shop’s relationship with it’s clients.

The remaining balance owed on the invoice, the date is was posted, and the accounting period it was posted in appears here.

If the invoice has been paid in full, the date it was paid will appear here.

The "Days until due" counter shows the number of days until the invoice is due to be paid. If the invoice is past due, the numbers will appear in red.

The invoice's description, billing instructions, payment status, and payments made by the clients can be viewed here by clicking through the tabs along the top.

The date that the invoice is due to be paid appears here.

All of the vital information about the invoice appears in this section - the invoice number, client, job, description, date, terms, and the dGL number from your chart of accounts.

The jobs associated with this invoice appear in this column. To edit a line item, highlight it from this list, then click the edit button. To remove one, highlight it, then click the delete button.

The tasks being billed for a particular job on this invoice appear here. To edit a line item, highlight it from this list, then click the edit button. To remove one, highlight it, then click the delete button.

The amount being billed for this task appears here.

The cGL number from your chart of accounts that is associated with this payment appears in this column.

An optional description of the tasks being billed goes here. It can be as detailed as is deemed necessary.

The total billing amount for this invoice is displayed here.

The gross total amount of this invoice (including tax, if applicable) appears here.

If an invoice is approved, the approved checkbox will be selected and the initials of the person who approved the invoice will appear here, along with the date and time that the invoice has been approved.

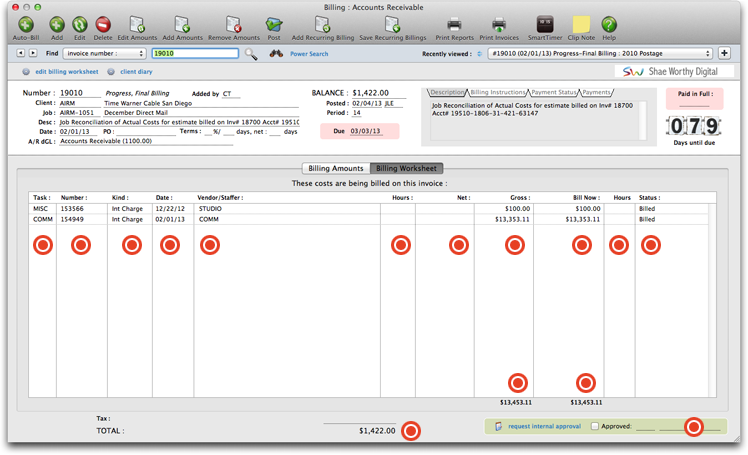

Client billings are based on job tasks, not literally the job’s costs. This means when you bill a job, the amount that’s billed is copied from the job task.

The charge number appears in this column.

The kind or type of job cost appears in this column.

The date the job cost was billed appears here.

The vendor or staff member associated with the job cost will appear in this column.

The number of hours spent on the task (if applicable) will appear here. If the job cost is for materials, this column may be blank.

The net cost of the job cost appears here.

The gross cost of the job cost will appear in this column.

This is the amount on the invoice that can be billed now.

This column lists the number of billable hours associated with the job cost.

The status of the job cost appears here.

The total billings (including tax, if applicable) appears here.

The total gross of all job costs appears here.

The total amount that can be billed now appears at the bottom of this column.

If the invoice is approved, the approved checkbox will be selected and the initials of the person who approved the invoice will appear here, along with the date and time that the invoice has been approved.

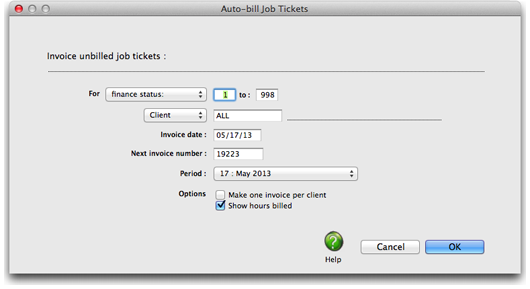

To invoice unbilled job tickets

Clients & Profits Agency provides an innovative feature that can

dramatically simplify your billing, called auto-billing. Auto-billing creates

invoices automatically for all of your unbilled jobs. It’s the same result as if

you’d entered an invoice for each of your unbilled jobs. Instead, auto-billing does

the work for you.

The auto-billing process is simple: unbilled jobs are chosen by production or

billing status. Clients & Profits searches your job database for every job with

unbilled tasks -- and with the status you’ve selected. Then an invoice is created

automatically, including a line item for every unbilled task on the job ticket. All

of the appropriate job details are copied to the invoices, so there’s no retyping.

Costs are billed automatically as invoices are saved. You can change the billing

amounts on job costs before the invoices are posted from the Billing Worksheet

window.

Jobs can be auto-billed by client or by project. Auto-billing one client’s jobs

makes it easy to make up the month’s billings quickly. Invoices are numbered

automatically, and are unposted. (The next invoice number is used by default, but

you can change it.) Once they are created, these invoices can be added to, edited,

or deleted any time until they are posted. You can even bill all of the client’s

jobs on one invoice.

Auto-billing and the job’s status

Unbilled jobs can be selected for automatic billing by production or billing status.

This is a good reason to track jobs by status, since it substantially automates your

monthly invoicing. If a job’s status is updated whenever it is ready to bill, the

work of figuring out which jobs are billable is eliminated. You’ll always know which

jobs are ready to bill by the status.

Since job lists, job summaries, and work in progress reports show jobs by billing

status, your accounting staff can print their own pre-billing reports. And using a

billing status doesn’t interfere with the production department’s job tracking,

since it’s completely separate.

Status codes are set up in the Status Table. You may not need many, but have one for

Ready to Bill, Estimate billed, On-hold, and Final Billed/Closed.

Changing the job’s production or billing status is easy: From the Job Tickets

window, find the job. Click on the Traffic button, then enter the job’s new status.

Once these changes are saved, the job and its new status appear immediately on

windows and reports.

To create invoices with the Auto-bill Job Tickets

function

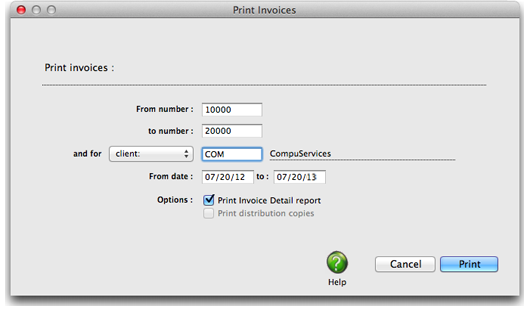

1 Choose Edit > Auto-bill.

The Auto-bill Job Tickets window opens.

Invoices are created for unbilled jobs, based on your selections. Unlike estimate or

progress/final billings, your options for showing unused tasks, using a percentage

billing, etc. aren’t available. Automatic invoices are simple, but complete -- and

can be changed as needed once they’re created.

2 Choose production status or billing status from

the From pop-up menu, then enter a range of status codes.

Unbilled jobs can be selected for any range of status codes. Either production

status or billing status can be used, depending on how your jobs are categorized. To

bill all jobs with unbilled tasks, enter the status range of 0 to 999. This range of

status codes will include jobs without a billing status. To only bill jobs with a

specific status, enter a more limited range of status codes (e.g., 30 - 50).

3 Choose client or project from the and for pop-up

menu, then enter a client number or project code.

Unbilled jobs can be selected for one client or project or all clients and all

projects. This option lets you easily bill one client’s unbilled at the same time.

It also gives you the option to easily bill one project’s jobs together on the same

invoice.

To bill all jobs with unbilled costs for one client only, enter a status range then

the client number. Only unbilled jobs open for the client will be automatically

billed.

4 Enter the invoice date.

The invoice date is the date that appears on the printed invoice. The client sees

this date as the date of the billing. It is used by the aging reports to calculate

an invoice’s age (i.e., 30 days, 60 days, 90 days). The date defaults to today, but

can be changed. It does not affect the posted date.

5 Enter the starting invoice number.

The next invoice number lets you set the numbering sequence for this batch of

invoices. The next number, based on the last invoice, is entered automatically. If

the last invoice number contained letters, the next number can’t increment -- and

you’ll have to enter your own number.

6 Enter the invoice’s accounting period.

The accounting period determines into which month these invoices will be posted. You

can select any period in the fiscal year unless it is locked (only the unlocked

periods can be chosen).

7 Select the auto-billed invoices options.

Instead of creating a separate invoice for each job with unbilled amounts, the make

one invoice per client option will combine the client’s jobs on one invoice. To show

the hours billed on the printed invoices, select the Show hours billed option.

8 Click OK -- then wait while the invoices are

automatically created.

The auto-bill function creates invoices by first compiling a list of unbilled jobs,

based on your selections. The unbilled job’s tasks are analyzed, then invoice

billing amounts are saved. These line items are then compiled together by job number

to complete the finished invoices.

Automatic billing can be time consuming, especially if you’re selecting many jobs

for billing. Invoices are created methodically, starting with the first unbilled job

that it finds. The entire auto-billing procedure must finish completely or else the

invoices will be incomplete. Since auto-billing is very demanding to your computer

system (i.e., disk intensive), it’s best to bill jobs automatically during slow

periods where few users are using Clients & Profits. Other users on the network may

notice slower performance on their systems when you’re auto-billing, especially if

you’re billing many jobs.

If the auto-billing procedure stops for any reason (someone cancels it, system

crash, power failure, etc.) then your invoices will be incomplete. In this

situation, delete the auto-billed invoices (explained later) then repeat the

auto-bill process.

Once the auto-bill invoices are saved, they can be proofed, posted, and printed just

like regular invoices. In fact, they are no different. They can be deleted,

appended, and edited any time until they are posted.

To delete unposted automatic billings

If, for any reason, the automatic billing didn’t do what you’d expected you can

easily delete all of the auto-billed invoices then start the process over. The

Delete All Unposted A/R command can be used to erase all of the auto-billed invoices

at one time.

1 Choose Edit > Delete All Unposted A/R.

2 Click Yes when prompted.

Keep in mind that this command deletes all unposted invoices, not just automatic

billings. If you have unposted job billings, estimate billings, etc., they will be

erased, too. Don’t use the Delete All command unless you want to delete every

unposted A/R invoice. Otherwise, you should delete the auto-billings individually.

Once invoices are posted, they can't be deleted. However, they can be unposted,

changed, then posted again.

Auto-bill one client’s jobs on the same invoice. The Auto-bill function will combine

all of a client’s unbilled jobs together on a single invoice when the make one

invoice option is selected.

To add a Job Billing Invoice

Client billing is based on jobs, tasks, and costs you've posted

against them. Job tickets track everything you spend by task, whether it's time,

buyouts, or out-of-pocket expenses.

Billing a job for its unbilled costs is the easiest, fastest way to add an invoice.

There’s really only one thing you need to know: the job number. Since jobs are

integrated with billing and accounts receivable, there’s no rekeying to make an

invoice.

When the job task is entered, the unbilled amount from the task is copied to the

invoice line item. The line item includes the task’s billing information (i.e.

description, cGL, and taxable status). Because it’s only a copy of the information,

changing information -- like the cGL or tax status -- on the invoice doesn’t affect

the job.

1 From the Accounts Receivable window, click the

add button (or choose Edit > Add New Invoice > Job Billing).

The Add Job Billing Invoice window opens.

2 Follow the remaining steps to continue adding a

job billing:

Invoice number New invoices are numbered automatically (using the invoice number

entered in Preferences). Invoices are numbered sequentially. You can change the

invoice number by selecting it and then entering your own number. You’ll be notified

if the invoice number has been used before.

Job number The last-used job number is entered automatically as a time-saver, but

can be changed. If you’re not sure about a job number, leave the field blank then

press Tab to open the jobs lookup list. Double-click on the job to copy it to this

invoice. You can enter any job number you wish, including jobs that are new, in

progress, or closed.

If the job has a status alert, you’ll see it as you tab past the job number field.

Client number Every invoice is billed to only one client. This client is the one who

will eventually pay for the invoice. The client number is copied automatically from

the job, but can be changed -- which lets you bill the job to a different client.

Tabbing past the client number copies its name, payment terms, and sales tax

information to the invoice. Any active client can be used on an invoice.

The job ticket and invoice can have different clients. There may be instances where

several departments of a large corporation open jobs, but invoices are billed to a

third-party. This third-party, such as the corporate headquarters, would be added as

a separate client and get all of the billings.

Debit account The default A/R account, which is copied from Preferences, can be

changed to a different G/L account. This account is debited for the invoice’s total,

including sales tax, when the invoice is posted.

Notes The work you’re billing can be fully explained in the invoice notes. These

notes, which appear near the top of the printed invoice (above the billing amounts),

can summarize what’s being billed on this invoice.

Job task for the first billing amount Press Tab to see the job’s tasks. Double-click

on the task to copy it to this invoice. Tabbing past the job task copies its

description, unbilled amount, unbilled hours, and credit G/L# to the invoice.

Task description, billing amount, hours billed, and income G/L number Changing the

task’s description here only affects this invoice; the job task itself is unchanged.

This description appears in the body of the printed invoice. The billing amount is

the actual amount your client will pay. It appears on the printed invoice, and

includes all costs, fees, commissions, and markups. You can bill the job task’s

entire unbilled amount by tabbing past the amount. Or, the billing amount can be

changed by entering a larger or smaller number (there’s no limit to how much or how

little you can charge on an invoice). The hours billed are optional, but can show

the client how many hours were billed on this job task. The credit G/L number is

used to track income on the financial statements. It is copied from the job task

(which was originally copied from the Task Table). Every line item can have a

different credit account, if needed. A cGL is required.

3 Repeat these steps to bill the job’s other

tasks, then click Save.

Once the invoice is added and saved, it must be posted. Posting makes the invoice

permanent, updating the job ticket, the client account, and the General Ledger. The

invoice can be proofed before posting, then changed as needed (e.g., amounts added

or removed, descriptions changed, etc.).

The roll up billing amounts by task option lets you customize how billing amounts

appear on the printed invoice. The roll-up option gives you the most flexibility in

billing, since it combines selected tasks into another task.

Adding an Estimate Billing Invoice

An estimate billing is an invoice created using the job's estimate

amounts, and not costs.

Otherwise, it looks and acts like progress/final billings. An estimate billing is a

fast, easy way to invoice a job’s estimate. Like progress/final billings, it’s an

express way to bill a job without having to know -- or type in -- each job task.

It’s fast (and accurate) because billing amounts are created automatically from the

job’s tasks and their estimate amounts. It’s easy because all you need to enter is

the job’s number.

If you always bill jobs based on a fixed estimate, then you’ll use the estimate

billing option often. If you generally bill jobs at completion, the estimate billing

option is useful when you sometimes need to bill a job -- or any part of it -- up

front (such as a big printing job, or the first job for a new client). When you add

an invoice using the estimate billing option, Clients & Profits looks at the job’s

tasks. Every task on the job with an estimate amount is copied to the invoice. The

task’s estimate amount (or any percentage) becomes the invoice’s billing amounts.

Estimate billings look like regular job invoices (the client won’t know that it’s an

estimate billing unless you say so somewhere on the invoice). Unlike advance

billings, estimate billings affect the job’s billed totals. Estimate billings can’t

be applied to later job invoices as payments. Also, estimate billings are considered

income and appear on the Income Statement. Once an estimate billing is created, you

can add, remove, and change its billing amounts as needed. The changes you make will

update the job’s totals when the invoice is posted.

To add an estimate billing

1 From the Accounts Receivable window, choose Edit

> Add New Invoice > Estimate Billing.

The Add Estimate Billing Invoice window opens.

2 Follow the remaining steps to add an estimate

billing:

Number New invoices are

numbered automatically (using the invoice number entered in Preferences).

Invoices are numbered sequentially. You can change the invoice number by

selecting it and then entering your own number. You’ll be notified if the

invoice number has been used before.

Job number The last-used job number is entered

automatically as a time-saver, but can be changed. If you’re not sure about a

job number, leave the field blank then press Tab to open the jobs lookup list.

Double-click on the job to copy it to this invoice. You can enter any job number

you wish, including jobs that are new, in progress, or closed.

If the job has a status alert, you’ll see it as you tab past the job number field.

The job’s estimate amounts are copied to the invoice automatically. The job’s

estimate amounts are billed by default at 100%, but can be easily changed by

modifying the bill estimate percentage or actually editing the billing amounts on

the tasks themselves.

Client number Every invoice

is billed to only one client. This client is the one who will eventually pay for

the invoice. The client number is copied automatically from the job, but can be

changed -- which lets you bill the job to a different client. Tabbing past the

client number copies its name, payment terms, and sales tax information to the

invoice. Any active client can be used on an invoice.

The job ticket and invoice can have different clients. There may be instances where

several departments of a large corporation open jobs, but invoices are billed to a

third-party. This third-party, such as the corporate headquarters, would be added as

a separate client and get all of the billings.

3 Enter the invoice date, due date, accounting

period, the client’s PO number, terms, and charge number.

Debit account The default

A/R account, which is copied from Preferences, can be changed to a different G/L

account. This account is debited for the invoice’s total, including sales tax,

when the invoice is posted.

Notes The work you’re billing can

be fully explained in the invoice notes. These notes, which appear near the top

of the printed invoice (above the billing amounts), can summarize what’s being

billed on this invoice.

Bill estimate percentage You can automatically

change the billing amounts for the entire invoice by changing the bill estimate

percentage then press Tab. The new percentage will be used to calculate the

invoice’s billing amounts. Any percentage of the estimate can be billed.

4 If needed, edit the invoice’s billing amounts

then click Save.

Only checked tasks will appear on the estimate invoice. To remove a task from this

invoice, uncheck the “X” checkbox. The description, billing amount, and income G/L#

can be changed for each job task on the invoice without affecting the job itself.

Once the invoice is added and saved, it must be posted. Posting makes the invoice

permanent, updating the job ticket, the client account, and the General Ledger. The

invoice can be proofed before posting, then changed as needed (e.g., amounts added

or removed, descriptions changed, etc.).

Adding a Progress/Final Billing

A Progress/Final Billing is the faster, easier way to invoice a

job's costs. It’s an express way to bill a job, without having to know -- or type in

-- each job task. It’s fast because billing amounts are created automatically for

the job’s tasks. And it’s easy because all you need to enter is the job number.

You’ll probably use progress/final invoices most often, since most jobs are billed

while in production or at completion (instead of, for example, when the job is

started). When you add an invoice using the progress/final billing type, Clients &

Profits looks at the job’s tasks. Every task on the job with an unbilled cost will

appear as a separate line item on the invoice (which includes even tasks that have

been partially billed before). The task’s unbilled amount becomes the invoice’s

billing amount.

There’s no distinction between a progress billing and a final billing. Both kinds of

billing are treated the same way: both create an invoice using the job’s unbilled

tasks. So use the progress/final option when you need to bill a job for costs, even

if it isn’t finished.

To add a progress/final billing

1 From the Accounts Receivable window, choose Edit

> Add New Invoice > Progress/Final Billing.

The Add Job Progress/Final Billing Invoice window opens.

2 Follow the steps to continue adding a job

progress/final billing invoice:

Invoice number and job

number As you tab past the job number field, Clients & Profits copies

the job’s unbilled tasks to the invoice. For each task you’ll see its task code,

description, unbilled hours, unbilled amount, and credit (i.e., income) G/L

number. Tasks without unbilled amounts are included, too (this lets you point

out to the client the tasks that aren’t yet completed, for example). These tasks

aren’t automatically saved with the invoice; to include these tasks, check the

“X” checkbox.

Client number The client number is copied from

the job ticket, but can be changed. This lets you bill a different client (such

as an accounting department) for this job’s charges.

3 Enter the invoice date, due date, and accounting

period.

4 Enter the client’s PO number, terms, and charge

number.

Debit (i.e., A/R) account

The debit G/L number indicates which receivable account will be updated when the

invoice is posted. Posting creates one journal entry that debits an Accounts

Receivable account for the invoice’s total amount, including sales tax.

Notes The work you’re billing can be fully

explained in the invoice notes. These notes, which appear near the top of the

printed invoice (above the billing amounts), can summarize what’s being billed

on this invoice.

Progress billing’s percentage The percentage

is used to calculate the invoice’s billing amounts. Any percentage of the job’s

unbilled costs can be billed. Normally, 100% of the job’s unbilled costs are

billed. To bill a portion of the job’s unbilled costs, enter the percentage then

press Tab. The invoice’s billing amounts will change instantly, reflecting the

new percentage.

5 Mark the “X” checkbox on the tasks that should

be included on this invoice.

Some or all of the job’s tasks can be included on a progress/final billing. This

lets you bill only certain tasks on an invoice, saving the others for a future

billing (it’s always up to you, since a job can be billed many times).

To include the job’s change order amounts, select the include change orders option;

the billing amount will reflect the task’s unbilled costs plus its change orders.

The include unbilled POs/IOs option combines the task’s unbilled costs and unbilled

commitments together in the billing amount. Use this option when you want to bill

for the job’s actual, posted costs as well as leftover purchase or insertion orders.

It lets you bill for what you expect the job’s final costs to be, before the

vendor’s invoices actually arrive. When the POs are eventually invoiced by the

vendor, you’ll have already billed for them. (The job’s unbilled totals will always

show the correct balances). The roll up billing amounts by task lets you consolidate

several tasks together into a single task; use it to show your client less detail

than actually exists on the invoice. The show hours billed option copies each job

task’s unbilled hours to the invoice. Use this option if your client requests to see

billed hours for each task.

6 Click Save.

When the invoice is saved, its billing amounts for each task are applied to the

job’s costs one-by-one. The task’s oldest costs are billed first. If the task’s

unbilled costs are billed completely, then their cost statuses will be changed to

“billed” automatically. Costs up to the billing amount will be changed to “billed.”

If a cost is only partially billed, the cost status changes to “partial”, the

remaining costs will keep a status of “unbilled.” You can see how Clients & Profits

allocated billings to costs by opening the invoice’s Billing Worksheet.

The invoice’s billing amounts can be changed anytime prior to posting the invoice.

There are no restrictions to the amount billed on invoices; you can bill for less or

more than the job’s costs if the invoice calls for it. The job’s work in progress is

updated automatically.

Adding a Work In Progress Billing

WIP billing lets you invoice a job's unbilled costs for any time

period. The WIP invoice bills job costs -- time, vendor purchases, expenses, and

internal charges -- for any week, month, or other time frame of your choosing.

Adding a work in progress billing is easy: all you need to know is the job number

and a date range. When you enter a range of dates, Clients & Profits lists all of

the job's unbilled costs that were added during that time period. You'll have a

chance to edit the billing amounts (and hours, too) for each cost. But while you see

the individual time entries, vendor purchases, out of pocket expenses, and internal

charges when adding the invoice, your client will only see the total billings for

each task. That's because Clients & Profits combines the job's billed costs together

by task when the invoice is saved.

You can attach a detailed list of billed costs to the invoice by printing the

Invoice Detail Report at the same time you print the invoice.

To add a WIP billing

1 From the Accounts Receivable window choose Edit

> Add New Invoice > WIP Billing.

The Add WIP Billing Invoice opens, prompting you to enter the work in progress

invoice's details.

2 Follow the remaining steps to continue adding a

WIP billing:

Invoice number New invoices

are numbered automatically (using the invoice number entered in Preferences).

Invoices are numbered sequentially. You can change the invoice number by

selecting it and then entering your own number. You’ll be notified if the

invoice number has been used before.

Job number The last-used job number is entered

automatically as a time-saver, but can be changed. If you’re not sure about a

job number, leave the field blank then press Tab to open the jobs lookup list.

Double-click on the job to copy it to this invoice. You can enter any job number

you wish, including jobs that are new, in progress, or closed.

If the job has a status alert, you’ll see it as you tab past the job number field.

Client number Every invoice

is billed to only one client. This client is the one who will eventually pay for

the invoice. The client number is copied automatically from the job, but can be

changed -- which lets you bill the job to a different client. Tabbing past the

client number copies its name, payment terms, and sales tax information to the

invoice. Any active client can be used on an invoice.

The job ticket and invoice can have different clients. There may be instances where

several departments of a large corporation open jobs, but invoices are billed to a

third-party. This third-party, such as the corporate headquarters, would be added as

a separate client and get all of the billings.

3 Enter the invoice date, due date, accounting

period, the client’s PO number, terms, and charge number.

Debit account The default

A/R account, which is copied from Preferences, can be changed to a different G/L

account. This account is debited for the invoice’s total, including sales tax,

when the invoice is posted.

Dates Enter a range of dates for which the

job's unbilled costs should be billed. The range of dates can be a week, a

month, a quarter, or any period of time. When you tab out of the date field,

Clients & Profits will select the job's unbilled costs that were added during

the time period, sorting them chronologically (oldest first) by task. Unbilled

time entries are selected by work date (i.e., the date on which the work was

performed), while vendor purchases are selected by invoice date. Expenses and

internal charges are selected by date added.

Check the roll up billing amounts by task option is you want the client the see less

detail on their printed invoice. The roll-up option gives you the most flexibility

in billing, since it selectively combines several tasks into another.

Billing amounts If needed,

enter a different billing amount or hours for each of the job's costs. Before

the invoice is saved you have a chance to tweak a billing amount for one or more

job costs. Changing the billing amount will only affect the client's invoice --

the gross amount on the cost is unaffected.

Notes Enter the invoice’s notes. The work

you’re billing can be fully explained in the invoice notes. These notes, which

appear near the top of the printed invoice (above the billing amounts), can

summarize what’s being billed on this invoice.

4 Click Save to save this WIP billing invoice.

Once the invoice is added and saved, it must be posted. Posting makes the invoice

permanent, updating the job ticket, the client account, and the General Ledger. The

invoice can be proofed before posting, then changed as needed (e.g., amounts added

or removed, descriptions changed, etc.).

Adding a Multi-job Billing Invoice

Special invoices can be created that bill different jobs and tasks

on the same invoice.

These invoices, called multi-job billings, let you consolidate jobs from various

clients onto a single invoice -- for one client. Multi-job invoices can make billing

large companies much easier, especially when you do work for many departments or

divisions of a corporation. Sometimes you may have a single billing contact or

location that gets the invoices, regardless of which department actually requested

the job.

Multi-job billing makes invoices for franchise clients easier. The costs of many

jobs and tasks can be split among many different franchises. Each franchise would

get their own invoice showing their portion of the work performed. Each invoice may

have dozens of jobs and tasks, but with only a part of the job’s total cost.

Multi-job invoices also work well when one client has a tremendous volume of work to

bill at once. Instead of billing each job separately with an invoice, all of the

client’s unbilled jobs can be added to the same invoice. The client gets one

invoice, with one invoice number. But the invoice might have dozens of jobs and

tasks, spread over many different pages.

Like standard job billings, multi-job invoices can be edited until they are posted.

Posting makes the invoice permanent, and updates the client account, job, and

General Ledger. Once an invoice is posted, it can be printed for the client. Posting

a multi-job billing increases the billed total on job tasks. The amount you bill is

subtracted from the job task’s unbilled total. For tasks without costs, the unbilled

total will appear negative; this isn’t a problem, since the unbilled balance

increases as job costs are posted. While multi-job billings have considerable

strengths, they have some disadvantages. Some billing types are better than others,

depending on just what you need to bill.

Multi-job billings don’t have the option to include change orders or open PO totals.

They can be included, however, if you enter them yourself.

The printed invoice for multi-job billings is tightly formatted, so it doesn’t have

the flexible display amounts (hide amounts, show previous billings, etc.) as other

billing types.

Multi-job billings don’t show hours billed.

Multi-job billings update work in progress job costs just like regular job invoices.

To add a multi-job billing

1 Choose Edit > Add New Invoice > Multi-Job

Billing

The Add Multi-Job Billing window opens.

2 Enter the invoice number.

3 Enter the client number.

This client is the one who will eventually pay for the invoice. It is entered

automatically from the job ticket, but can be changed. Tabbing past the client

number displays its name, payment terms, and other account information.

4 Enter the invoice date, accounting period, and

due date.

5 Enter the client’s PO number, terms, and charge

number.

6 Enter the invoice’s debit account.

The debit G/L number indicates which receivable account will be updated when the

invoice is posted. Posting creates one journal entry that debits an Accounts

Receivable account for the invoice’s total amount, including sales tax.

7 Enter the invoice’s notes.

The work you’re billing can be fully explained in the invoice notes. These notes,

which appear near the top of the printed invoice (above the billing amounts), can

summarize what’s being billed on this invoice.

8 Enter the job number and task.

Any client’s jobs and tasks can be added to a multi-job billing. These billing

amounts will be charged to the invoice’s client -- which can be different from the

client who opened the jobs. Tabbing past the task copies the task’s unbilled amount,

hours and cGL from the job to the invoice.

9 Enter the job task’s billing amount, unbilled

hours, and credit G/L number.

The task’s unbilled costs are copied to the invoice line item. This amount can be

easily changed by typing in a different billing amount. You can bill for more or

less than the task’s unbilled costs. Each job’s billing amounts are sub-totaled

together on the printed invoice, so the client will still see the total billings for

each job.

10 Repeat steps 8-9 for any other job/task

combinations, then click Save.

A multi-job billing can contain dozens of line items from any number of jobs and

tasks. When the invoice is saved, billing amounts for each line item will be applied

to the job’s costs just like other kinds of invoices (i.e., oldest costs are billed

first), updating each job’s work in progress automatically.

To bill multiple jobs with just one amount for each job without listing all tasks,

use the roll-up option in the Job Billing window. The roll-up option gives you the

most flexibility in billing, since it selectively combines several tasks into

another.

Adding a New Media Billing

Clients & Profits makes billing insertion orders a snap, literally -

just a few clicks with your mouse.

That's because most of the work to create a media invoice is already completed: the

information is already on the insertion order. Media invoices are added for one

specific client. A single media invoice can contain dozens of insertion orders. Each

insertion order appears as a separate billing amount on the printed invoice. The

media invoice looks different than job invoices. The printed invoice shows the

publication, issue date, ad#/caption, and more directly from the insertion order.

Since media invoices are based on insertion orders, it's critical that your

insertions are added accurately - and updated in Clients & Profits when something

changes (like the gross cost or the issue date). That's because whatever information

appears on the insertion order will also appear on the client's media invoice.

Media billings are different than pre-billings. A pre-billed insertion order appears

on its own invoice before the cost has been invoiced by the publication. In this

case you don't really know the ad's final cost, so you're essentially billing from a

best-guess. Since the ad's cost is based on the publication's rate card, the cost

might not change from the date the order was placed to the date of publication.

If the cost does change, however, your pre-billing invoice will have the wrong

amount. Media billings may also have this potential problem if they're billed before

the ad runs. If so, you'll need to verify the ad's actual cost with your media

billing amount - then bill the client for any differences.

To add a media billing

1 Choose Edit > Add New Invoice > Media Billing.

The Add New Media Billing window opens.

2 Enter the client number.

3 Enter the invoice date, due date, and accounting

period.

The invoice date and the accounting period can be different, for flexibility. This

means an invoice can be dated in this month, but the invoice can be posted to next

month's financial period.

4 Enter the client's PO number and terms.

5 Enter the invoice's debit account.

The debit G/L number is copied from Preferences and indicates which receivable

account will be updated when the invoice is posted. Posting creates one journal

entry that debits an Accounts Receivable account for the invoice's total amount,

including sales tax.

6 Enter the invoice's notes.

The work you're billing can be fully explained in the invoice notes. These notes,

which appear near the top of the printed invoice (above the billing amounts), can

summarize what's being billed on this invoice.

7 Select to bill Insertion Orders or Broadcast

Orders and enter the space close date.

The Media Billing Options lists unbilled insertion orders by number, generally with

the oldest ones shown first. Checking an insertion order's checkbox selects it for

this invoice. The insertion order's billing amount can be changed (either up or

down, there's no restrictions) to tailor the invoice's billing amount.

Each selected order will appear as a separate billing amount on the printed invoice.

To bill all of the client's unbilled insertion or broadcast orders, check the Select

All option.

8 Click Save.

The design of the media invoice is different from regular job invoices, since it

shows each insertion's publication, issue date, and other information. Broadcast

Orders are billed just like Insertion Orders, but the printed invoice shows flight

dates, broadcast month, and other broadcast information. For this reason, the

standard invoice display options aren't applicable to media invoices. Unless you've

changed it in the Media Billing Options window, the insertion or broadcast order's

gross cost is copied to the line item's billing amount. You can add, change, and

remove billing amounts any time before the invoice is posted.

Billing commission only. If a client pays the

media directly, it can be billed for commission amounts only by choosing the bill

commission only option. Every media buys from the insertion or broadcast order will

appear on the invoice. The media commission is calculated as the difference between

the media buy's gross amount less its net amount.

Adding a New Retainer Billing Invoice

Client retainers are special-purpose invoices that bill clients, but

don't count as income. Retainer billings aren’t considered earned income, since you

haven’t done the work yet. Instead, retainers are billed as deposits against future

billings.

Retainers can only be billed from each client’s retainer schedule. The retainer

schedule contains descriptions and amounts for up to twelve monthly billings. When

you add a retainer invoice, you’ll be prompted to select a retainer to bill from the

client’s schedule. Details about the billing are copied from the client account to

the invoice, so there’s very little for you to type.

When a retainer is posted, the balance updates the client account -- but only the

client’s retainer balance, not the usual account balance. Retainers update the

General Ledger, crediting a liability account (which you choose) for client

deposits/retainers and debiting accounts receivable. Retainers don’t increase the

client’s account balance, so you won’t confuse regular unpaid invoices from unpaid

retainers. Instead, a special unpaid retainers’ balance tracks them separately.

Retainers can be applied to any unposted job billing. When a retainer is applied to

an invoice, the retainer amount appears as a payment. When the invoice is posted,

your client sees the invoice’s line items and billing amounts, sales tax, and grand

total -- then the balance due, less the amount applied from retainers.

There are cases where retainers shouldn’t be billed as retainers: If a client pays

you a flat monthly fee that isn’t applied to job billings, then it shouldn’t be

billed as a retainer. These fees, which usually cover the client’s account service

hours, are really earned income because you won’t give the money back if you do no

work. Remember, retainers don’t affect your income statement or the client’s balance

due. Fee invoices should be added as miscellaneous billings, not retainers.

To add a retainer billing

1 From the Accounts Receivable window, choose Edit

> Add New Invoice > Retainer Billing.

The Add New Retainer Invoice window opens.

2 Enter the invoice number.

3 Enter the invoice’s bill-to client number.

Retainer invoices are billed to one client, and only clients that have a retainer

schedule. When you tab past the client number, the client’s scheduled retainer

billings are copied to the invoice. Any unbilled retainer can be billed on a

retainer invoice. Previously billed retainers are disabled, since they have already

been billed.

4 Enter the invoice date, accounting period, the

client’s purchase order number, and payment terms.

The invoice date and the accounting period can be different, for flexibility. This

means an invoice can be dated in this month , but the invoice can be posted to next

month’s financial period.

5 Enter the invoice’s debit and credit G/L

accounts.

The retainer’s cGL and dGL are copied from the client’s retainer schedule, but can

be changed. A special A/R account can be created for tracking retainer receivables,

to keep them separate on financial statements. Likewise, a special

“deposits/advances” liability account can be created to track retainer billings.

When a retainer invoice is posted, it will post debit and credit journal entries to

these accounts.

6 Enter the invoice’s due date.

7 Click the bill these checkboxes to add retainer

billings to this invoice.

You can bill one or more monthly retainers on the same invoice, although usually

only one is billed per month. Each monthly retainer appears as a separate line item,

with its own billing amount, on the printed invoice. The retainer’s description is

copied to the line item and is what the client sees on the printed invoice. You can

change the description as needed; however, changing the description here changes the

retainer schedule as well. The retainer amount can also be changed, letting you bill

more or less than what was scheduled; changing the amount here changes the retainer

schedule.

8 Click Save.

To see a client’s retainer schedule

1 Choose My > My Clients.

2 Click on the Retainers link.

The Retainer Schedule window shows the client’s retainer history, including which

retainers have been billed so far. The status checkbox indicates which retainers

have been billed, including the date and invoice number. Billed retainers can’t be

changed. Unused retainer is the amount that can be applied as payments to the

client’s upcoming invoices. Unpaid retainers shows the balance of the client’s

unpaid retainer billings. You can use this amount to track if the client has paid

the retainer invoices (you may not want to apply retainers to new invoices unless

they’ve been paid already).

Add Advance Billing

Advances are special invoices that bill a job's estimate before the

work has started. They are special because the billing amounts on advance invoices

aren’t considered income; instead, they are counted as unearned revenue, or a

liability on the financial statements.

Advances act like client retainers, but are associated with one specific job. They

let you bill up front for a job (using any part of its estimate), then apply these

billings later when the job’s actual costs are billed. The amounts you apply to

later invoices are handled like payments; the invoice’s balance due will be the

invoice total less the applied advances. Advance billings do not involve job tasks.

You can include a complete description about the advance billing on the printed

invoice.

Here’s what happens: When an advance billing is posted, a debit journal entry is

posted into Accounts Receivable and a credit journal entry is posted into Client

Advances. Unlike retainers, advance billings do increase the client’s balance.

Advance invoices appear on aging reports, and are paid off in Client Payments just

like other invoices.

Because advanced billings are deposits (representing unearned income), they are not

taxable. The job will be taxed in full when it is finally billed.

To add an advance billing

1 Choose Edit > Add New Invoice > Advance Billing.

2 Enter the invoice number.

3 Enter the job number.

The last-used job number is entered automatically as a time-saver, but can be

changed. If you’re not sure about a job number, leave the field blank then press Tab

to open the jobs lookup list. Double-click on the job to copy it to this invoice.

You can enter any job number you wish, including jobs that are new, in progress, or

closed.

If the job has a status alert, you’ll see it as you tab past the job number field.

The job’s total estimate is calculated and displayed.

4 Enter the bill-to client number.

Every invoice is billed to only one client. This client is the one who will

eventually pay for the invoice. The client number is copied automatically from the

job, but can be changed -- which lets you bill the job to a different client.

Tabbing past the client number copies its name, payment terms, and sales tax

information to the invoice. Any active client can be used on an invoice.

5 Enter the invoice date, due date, accounting

period, the client’s PO number, terms, and charge number.

6 Enter the invoice’s debit G/L account, charge

number, and notes.

The default A/R account, which is copied from Preferences, can be changed to a

different G/L account. This account is debited for the invoice’s total when the

invoice is posted. The work you’re billing can be fully explained in the invoice

notes. These notes, which appear near the top of the printed invoice (above the

billing amounts), can summarize what’s being billed on this invoice.

7 Enter the advance billing amount.

The Add Advance Billing window totals up the job’s estimate, along with the total of

any previous advance billings. You can bill all or part of the job’s estimate by

entering any percentage up to 100%. Tabbing past the percentage calculates the

advance billing amount. This is the amount that will appear on the printed invoice.

8 Enter the invoice’s “advanced billing” credit

G/L account.

The advance billing credit G/L number should be your liability account for client

deposits/advances. The account is entered automatically from Preferences, if it was

entered there.

9 Click Save.

Posting the invoice updates the job’s advance billings total, but doesn’t affect any

tasks. Later, the advance billing amount can be applied to the job’s invoices

sometime in the future, where it’ll appear as a client payment.

To see the job’s advance billings

From the Job Ticket window, click on the Snapshot button.

The advance billing amount appears at the bottom right side of the Snapshot window.

This amount is the running total of the job’s advance billings, less any amounts

applied to the job’s invoices. When you bill a job later for its costs, this is the

amount you can apply as a payment.

The Advance Billing report can be printed by choosing View > Job Tickets > File >

Print > Print Reports > Analysis > Advance Billings. This report can be printed for

one or all clients or client projects for a specified date range. It can also be

limited to a production or billing status code range.

If you have an advance billings balance after the job’s final billing, then you’ve

overbilled the job. Since advance billings can’t be applied to other jobs, adjusting

entries will have to be made to this job: Add an invoice for the job’s remaining

balance, then apply the advance billing balance as a payment. Post this adjusting

invoice, then add another invoice for the same job and task -- but with a negative

amount. This invoice will appear on the client ledger as a credit. It can be applied

to other invoices later when new client payments are added.

Add New Miscellaneous Billing

Invoices don't have to reference a job number or task. These

billings, called miscellaneous invoices (as opposed to job invoices), let you bill

clients for non-job charges such as consulting fees, commissions,and service charges

-- as well as credits and adjustments -- without affecting job tickets.

Miscellaneous invoices aren’t commonly used, since most of your work revolves around

jobs. Adding client invoices updates your income statement, but doesn’t affect jobs

or tasks. That, after all, is the point of miscellaneous invoices: use them to bill

for anything that is not related to jobs.

Since miscellaneous invoices don’t include job numbers, they don’t contain job

tasks. So for the invoice line items you’ll simply describe what you’re billing.

Miscellaneous invoices can be edited until they are posted. They appear on proof

lists, billing reports, and client statements just like job billings, but don’t show

jobs and tasks. Posting makes client invoices permanent, updating the client account

and General Ledger. Once an invoice is posted, it can be printed for the client.

To add a miscellaneous billing

1 Choose Edit > Add New Invoice > Miscellaneous

Billing.

The Add New Miscellaneous Billing window opens.

2 Enter the invoice number.

3 Enter the bill-to client number.

4 Enter the invoice date and accounting period.

Aging reports use the invoice date to calculate an unpaid invoice’s age (i.e.,

current, 30-days, 60-days, etc.). The invoice date and the accounting period can be

different, for flexibility. This means an invoice can be dated in this month, but

the invoice can be posted to next month’s financial period.

5 Enter the client’s PO number and payment terms.

6 Enter the invoice’s debit G/L account.

The debit G/L number is copied from Preferences and indicates which receivable

account will be updated when the invoice is posted. Posting creates one journal

entry that debits an Accounts Receivable account for the invoice’s total amount.

7 Enter the invoice’s notes.

The work you’re billing can be fully explained in the invoice notes. These notes,

which appear near the top of the printed invoice (above the billing amounts), can

summarize what’s being billed on this invoice.

8 Enter the line item’s description.

The description field appears in the body of the invoice. Each invoice line item

should have a clear, concise description that explains what you’re billing. You can

enter anything you need to describe the line item.

The line item’s description becomes the credit journal entry’s description when the

invoice is posted. You’ll see this description on audit trails and journals.

9 Enter the line item’s amount (if this is a

credit, enter a negative amount) then enter the cGL.

Each line item can have a billing amount and credit G/L number, or cGL. The cGL

account is entered automatically from preferences, but can be changed.

If you don’t know which credit G/L account to use, leave it blank then choose Chart

of Accounts from the Lookup List. Your chart of accounts appears, showing your G/L

numbers. To select an account, double-click on the account name. The account number

will be entered onto the line item automatically.

10 Click Save.

Clicking the Save button saves this invoice’s line item and billing amounts.

The invoice is saved, but not posted. You can add additional line items, or change

the invoice’s billing amounts until the invoice is posted.

Miscellaneous billings don’t affect jobs. They’re ideal for one-time billings for

small charges like consulting, royalties, expense reimbursements, and fees.

Adding a Finance Charge Billing

Finance Charge Billings are like miscellaneous billings. They don’t

reference job numbers or tasks, so don’t affect job totals. Instead, they are used

to specifically bill a late-paying client for finance or service charges. These

invoices look like regular invoices, and aren’t handled differently by Clients &

Profits. They post to the General Ledger just like miscellaneous billings. The only

difference is they have the “finance charge” billing type.

To add a finance charge billing

1 From the Accounts Receivable window, choose Edit

> Add New Invoice > Finance Charge.

The Add Finance Charge window opens.

2 Follow the remaining steps to continue adding a

finance charge billing.

Client number Every invoice

is billed to only one client, and any client in your database can be used on an

invoice. This client is the one who will eventually pay for the invoice. Tabbing

past the client number displays its name, payment terms, and other account

information.

3 Enter the invoice date, due date, and accounting

period.

Aging reports use the invoice date to calculate an unpaid invoice’s age (i.e.,

current, 30-days, 60-days, etc.).

The invoice date and the accounting period can be different, for flexibility. This

means an invoice can be dated in this month, but the invoice can be posted to next

month’s financial period.

4 Enter the client’s PO number, terms, and charge

number.

Debit account The debit G/L

number is copied from Preferences and indicates which receivable account will be

updated when the invoice is posted. Posting creates one journal entry that

debits an Accounts Receivable account for the invoice’s total amount.

Notes The finance charges you’re billing can

be fully explained in the invoice notes. These notes, which appear near the top

of the printed invoice (above the billing amounts), can summarize what’s being

billed on this invoice.

Description The description field appears in

the body of the invoice. Each invoice line item should have a clear, concise

description that explains what you’re billing. You can enter anything you need

to describe the line item.

The line item’s description becomes the credit journal entry’s description when the

invoice is posted. You’ll see this description on audit trails and journals.

Finance charge amount The

finance charge amount can be calculated on the Client Account Aging or Client

Statement, then entered here. (Finance charges aren’t automatically

billed.)

cGL Each line item can have a billing amount and credit G/L number, or cGL. The cGL

account is entered automatically from preferences, but can be changed.

If you don’t know which credit G/L account to use, leave it blank then choose Chart

of Accounts from the Lookup List. Your chart of accounts appears, showing your G/L

numbers. To select an account, double-click on the account name. The account number

will be entered onto the line item automatically.

11 Click Save.

Clicking the Save button saves this invoice’s line item and billing amounts.

The invoice is saved, but not posted. You can add additional line items, or change

the invoice’s billing amounts until the invoice is posted.

Finance charges. While finance charges are calculated on aging reports, they aren’t

automatically billed to clients. Instead, separate finance charge invoices are added

then printed for the client.

Editing an Invoice

Anything on an unposted invoice can be changed, except the invoice

number, before an invoice is posted. Once an invoice is posted, you can only change

the description and other basic information.

1 From the Accounts Receivable window, find an

invoice.

2 Click the edit button.

3 Make your changes, then click Save.

Deleting an Invoice

Once an invoice is posted, it can’t be deleted -- only adjusted with

credit invoices. Or it can be unposted if it hasn’t been paid yet.

1 From the Accounts Payable window, find the

invoice.

2 Click on the delete button, or choose Edit >

Delete.

Once the invoice is deleted, its number can be used again.

Adding, Editing, and Deleting Billing Amounts

Billing line items contain the real details about an invoice. Almost

everything about an invoice line item can be changed until the invoice is posted.

The invoice itself only contains a general description of the billing, while the

line items contain the actual tasks and amounts. Almost everything about an invoice

line item can be changed until the invoice is posted. However, invoice numbers

cannot be changed.

On job billings, information from the job task is copied to the line item when the

invoice is added. These details, such as the task name, group, sort, description,

and sales tax settings appear on the printed invoice. An invoice can have dozens of

line items and billing amounts -- as many as you need to create a complete billing.

Once an invoice is posted, only the invoice’s description, group, and sort can be

changed. This information can be changed because it doesn’t affect the client

balance, job totals, or the General Ledger. The line item’s billing amount, cGL, and

sales tax settings can’t be changed because they affect the invoice’s total.

To edit an invoice’s line item

1 From the Accounts Receivable window, find an

invoice.

2 Double-click on the invoice line item you wish

to edit.

The Edit Invoice Amount window opens.

You’ll see the invoice line item’s details, including the billing amount. The

billing amount can be changed here, or can be changed with the invoice’s other line

items in the Edit Amounts window.

3 Make your changes, then click Save.

The changes you make update the invoice instantly. They will appear on the invoice

the next time it is printed. The line item’s invoice number, client, and job number

can’t be changed since they belong to the invoice, not the line item.

Invoice line items can’t be deleted or added from the Edit Invoice Amounts window.

To delete this line item, click Cancel then choose Edit > Remove Amount. To add a

new line item instead, click Cancel then choose Add Amount from the Edit menu. Each

line item on an invoice gets a billing amount. The billing amount is copied from the

job task’s unbilled total automatically. The job task’s unbilled amount is based on

the costs you’ve entered so far, less what’s been previously billed. The invoice’s

billing amounts don’t have to match the job’s totals -- so you have the freedom to

bill for more or for less than the job’s costs.

This flexibility means you can create invoices that show what you really want to

bill, and not just what the computer says should be invoiced. The billing amounts

you enter update the client balance, job totals, and General Ledger automatically

during posting, so no additional entries are needed.

Every line item on an invoice creates a separate credit journal entry in the General

Ledger. Usually, each line item credits an income account; however, you can use any

account you wish. An invoice’s billing amounts can be changed anytime, as often as

needed, until the invoice is posted. Posting updates the client, job, and financial

statements -- so an invoice can’t be changed once it’s posted.

Formatting billing amounts on the invoice

Invoice line items can be formatted in different ways on the printed invoice. These

options let you show more or less information on each invoice, depending on what

your client wants (or needs) to see. The ability to selectively show and hide

billing amounts means you can bill a job completely, adding all of its tasks to an

invoice, but hiding the details from the client.

The invoice’s display options are set on each individual invoice. The default

setting shows all of the invoice’s tasks and billing amounts. Using a different

display option doesn’t affect the client balance, job totals, or General Ledger;

instead, it’s strictly a cosmetic feature on the printed invoice.

To edit the invoice’s billing amounts

An invoice line item’s billing amount can be edited until the invoice is posted.

Once the invoice is posted, it can’t be changed.

1 From the Accounts Receivable window, find the

invoice.

2 Click on the edit Amounts button.

3 Change the billing amount (or amounts) by

tabbing from line to line

4 Click Save.

The billing amount appears on the invoice immediately.

Changing an invoice line item’s billing amount doesn’t change the cost’s billing

information for the task. If you change a billing amount for a job billing, you may

need to adjust your cost’s billed amount. To change the cost’s billing information,

choose Edit > Billing Worksheet.

To remove a billing amount

1 From the Accounts Receivable window, find an

invoice.

2 Click once on an invoice line item to select it.

3 Click the remove button (or choose Edit > Remove

Amount.)

Removing a billing amount is permanent. Line items can be removed only from unposted

invoices. Once removed, however, the same task can be added again, if needed.

Invoices need billing amounts just like job tickets needs tasks. It’s these invoice

line items that contain the important information about what you’re billing.

To add an additional billing amount to an invoice

Job tasks aren’t literally appearing on invoices. Instead, information from a job

task is copied to an invoice line item. The line item contains the task’s billing

information (including description, credit G/L accounts, taxable status, and

unbilled amount), but it is actually only a copy of the job task. That’s why you can

change an invoice line item without affecting the job task. The same job task can be

billed one or more times on the same invoice, if needed. New billing amounts (i.e.,

line items) can be added to an invoice anytime prior to posting. Each billing amount

makes a separate journal entry in the General Ledger. Each line item credits an

income account, such as Creative Fees, based on the job task’s cGL. The Add Billing

Amounts window will look different depending on the invoice’s billing type.

1 Click the add Amount button, or choose Edit >

Add Amount.

The Add Billing Amounts window opens, showing the invoice’s existing line items and

billing amounts.

2 Enter the task, then press Tab.

The job task’s description, unbilled amount, unbilled hours, group, sort, and

roll-up task are copied to the new line item. Clients see the line item’s

description, so it shouldn’t contain anything confidential.

3 Enter the billing amount, hours billed, cGL,

etc. then click Save.

The billing amount is the actual amount your client will pay. It appears on the

printed invoice, and includes all costs, fees, commissions, and markups (there’s no

limit to how much or how little you can charge on an invoice). The hours billed are

optional, but can show the client how many hours were billed on this job task. The

credit G/L number is used to track income on the financial statements. Group and

sort are used to arrange billing amounts on printed invoices. Line items are

sub-totaled by group, just like estimates. Within each group, billing amounts are

sorted in order by their sort number.

The invoice’s billing amounts are saved, but not posted. You can change the

invoice’s line items anytime until the invoice is posted.

Editing invoice amounts. Billing amounts are edited by double-click on an invoice

line item. The task can’t be changed, but the task’s description can be edited. The

task code doesn’t appear on the printed invoice.

Billing amount descriptions. The invoice’s billing amount descriptions can be edited

without affecting the original job ticket. Clients see the billing amounts and task

descriptions, but not the task code itself. Billing amounts can be combined together

by entering a roll-up task.

Credit Invoices

Credit Invoices can be made for a client by entering an invoice with

negative billing amounts. When a credit invoice is added as a job billing, the

credits will reduce the amount billed on the job ticket; if it's added as a

miscellaneous billing, the credit will only affect the client balance.

When entering a client payment against a credit invoice, in the payment column of

the invoice distribution window enter a negative amount against the negative

(credit) invoices. Doing this will net out the client payment to match the amount of

the client's check and clear both the normal positive invoices and the credit

invoices.

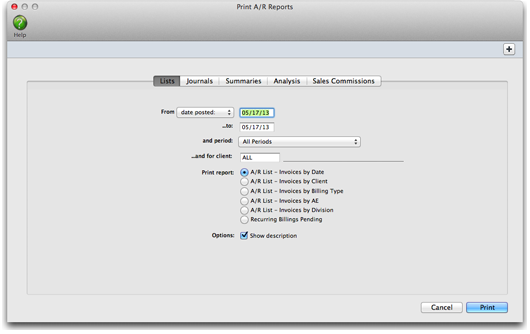

Printing A/R Reports

A/R Reports summarize invoices, showing what you've billed to

clients, jobs, and G/L accounts.

A/R reports can be used for reporting sales, tracking billings by client, and

auditing your accounting. There are several different reports that show your

billings from various perspectives; all reports, however, are based on posted

invoices.

Invoices can be summarized for any period of time (choosing either invoice date or

date posted), for one period or all periods, and for one client or all clients.

These options let you find the billings for a specific purpose, such as the

quarter’s billings for client ABC.

A/R reports show only posted invoices; unposted invoices appear only on proof lists.

Accounts receivable reports are different from client account agings, since they

show both paid and unpaid invoices (aging reports show only unpaid invoices).

Tips for printing A/R reports

Invoices are selected primarily by invoice date or date posted. This option lets you

show only invoices added in July, for example, instead of the entire year. By

entering a range of dates, you can select all invoices added today, last week, or

all month -- whatever time period you need. There’s no limit to which range of dates

you can use.

Reports can be printed one at a time by clicking on a report name. The print window

remains open after print the report. This allows you to run another report with the

same criteria, or edit the selections and rerun the same report. Reports can be

printed then reprinted with different selections, as often as needed.

A/R reports are normally printed either to the printer or the screen. By using Print

Destinations under the File menu, you can export to a spread-sheet compatible text

file, print in PDF or HTML format or even e-mail your billing reports.

To show the invoice description, click on the Show Description option. This option

makes your billing reports longer, but more descriptive.

To print A/R reports

1 Click the print Reports button (or choose File >

Print A/R Reports).

2 Select invoice date or date posted from the From

pop-up menu, then enter a range of dates.

3 Select an accounting period, or choose All

Periods to see invoices by date only.

4 Enter a client number, or leave the selection as

ALL.

To see invoices for one accounting period only, regardless of date, choose a period

from the pop-up menu then enter a very large range of dates (e.g., 1/1/12 -

12/31/12).

5 Select the report you wish to print.

6 Click Print.

To print another report repeat steps 2-6.

Billing and A/R Reports

A/R List Invoices by Date

The A/R List Invoices by Date provides a concise checklist of all invoices added for

a time period, but does not show the line item detail.

A/R List Invoices by Client

The A/R List Invoices by Client shows all invoices added for a time period and

sub-totals by client number.

A/R List Invoices by Billing Type

The A/R List Invoices by Billing Type shows all invoices added for a time period and

subtotals them by billing type. It prints one page per billing type.

A/R List Invoices by AE

The A/R List Invoices by AE shows all invoices added for a time period for an AE and

subtotals them by client. It prints one page per AE.

A/R List Invoices by Division

The A/R List Invoices by Division shows all invoices added for a time period for a

division and subtotals them by client. It prints one page per division.

Recurring Billings Pending The Recurring Billings Pending report shows all pending

invoices for a client within a specified time period. Once an invoice has been

created, it no longer appears on this report.

A/R Journal

The A/R Journal shows invoices along with line item and G/L details. Use the A/R

Journal to get a detailed listing of billings for a time period.

A/R Summary - Billings by cGL

The Billing Analysis/Billing Recap by cGL lists invoices by credit account. It is a

helpful auditing report since it corresponds to the G/L audit trail for income

accounts.

Group Billings

The Group Billings report shows billing amounts subtotaled by task groups.

Choose to show line-by-line detail (i.e. individual invoices) or task group totals

only.

Client Billing Summary (Cover Sheet)

The Client Billing Summary is a cover sheet for a batch of printed invoices. It can

be attached to a large batch of client invoices (which are printed together) to make

the billing amounts clearer to the client’s accounting department.

Sales Tax The Sales Tax Analysis report lists for a specified time period all

invoices by client with their sales tax totals. Each invoice shows the total amount,

the taxable amount for each tax rate, and the amount of sales tax calculated for

each rate. The first section of the report shows all invoices that were designated

as non taxable. The taxable sales, non-taxable sales, and sales tax totals on this

report make compiling your sales tax returns easy to do.

Media Accrual/Open Orders Summary

The Media Accrual/Open Orders Summary report lists for a specified time period all

media orders that have been billed to the client but not yet invoiced in Accounts

Payable by the vendor. There is an option to include closed orders on the report

too.

Billing Analysis - by AE

The Billing Analysis by AE lists invoices added for each account executive,

subtotaled by client. Together with the Billing Recap, these reports can be used to

compare billings for each account executive or account team.

Billing Recap - by AE

The Billing Recap by AE report shows each account executive's billings as a

percentage of total billings. Account executives and account teams are ranked by

total billings.

Billing Analysis - by Project

The Billing Analysis by Project lists invoices added for each project, subtotaled by

client.

Billing Analysis - by Group

The Billing Analysis by Group lists invoices added for each task group,

subtotaled by client.

Sales Commissions by AE

The Sales Commission by AE report lists all invoices added for each account

executive, subtotaled by client. Each invoice shows the commissionable billing