Add Job Cost Invoice

Job cost invoices track purchases made from vendors or suppliers that will be billed to clients.

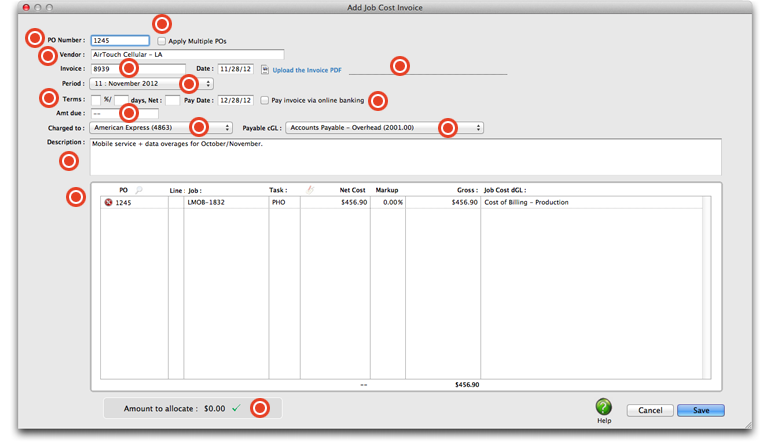

Entering a purchase order number here will automatically copy in the purchase order's vendor and total amount due. Each line item from the purcahse order will be copied into the distribution section of the job cost invoice.

If you want this to apply to multiple purchase orders, select this checkbox.

Every invoice needs a vendor number, which links the invoice with the vendor account. The invoice date should be entered from the invoice itself. It is the date the vendor issued the invoice, not the date it was received.

This is the amount due to the vendor for this invoice, including shipping, sales tax, and any additional charges. This is the amount you’ll pay the vendor, and not the amount you’ll bill your clients. The invoice amount updates the vendor balance. The amount is credited to the A/P account in the General Ledger.

If you have a PDF of the printed invoice, attach it by clicking this link. You will be prompted to locate the PDF from your hard drive or local server.

The invoice can be posted into any unlocked accounting period. The period determines which month will be updated when the invoice is posted. The current accounting period is entered automatically, but can be changed by choosing a period from the pop-up menu.

The invoice’s payment terms indicate when and how the invoice should be paid. Payment terms have three parts: the discount percentage, the early payment period in days, and the net number of days until the invoice is due. Payment terms are copied from the vendor account, but they can be customized on the invoice.

The credit G/L account (i.e., cGL) is a liability account, and would be one of your Accounts Payable accounts. It is copied from the vendor file, but can be changed on the invoice. The cGL should always be an A/P liability account. If not, your subsidiary ledger will not equal your balance sheet.

To pay this invoice via online banking, select this checkbox. Online payments are added into C&P through the checkbook, just like a conventional printed check. You can record online payments into C&P as soon as you make them, or record them later from your bank statement.

This is the amount due to the vendor for this invoice, including shipping, sales tax, and any additional charges. This is the amount you’ll pay the vendor, and not the amount you’ll bill your clients. The invoice amount updates the vendor balance.

A/P invoices can be charged to a credit card by selecting one from the "Charged to" pop-up menu. By doing this, you can later clear A/P invoices paid by a credit card and add remaining charges in one step in the Add Credit Card Statement window.

If you don't know the po's number, you can click on the Lookup link to view all open purchase orders for the vendor. Double click on a po number to select it. If you entered a PO number, the job and task are entered automatically from the purchase order; if not, you need to enter it. The markup is copied from the vendor account first, then the job task.

The description explains what was purchased. It appears everywhere the invoice appears, including job cost reports and G/L journal entries. It’s customizable, so you can enter anything that helps document the invoice.

This is the total amount of the A/P invoice allocated to agency direct service costs, agency billings, agency income, or agency direct client hours.

To bypass this option, simply choose Edit > Add New Invoice and choose the type of invoice you wish to add.

If you don't know which PO line item to use, delete the line number then press tab. The Lookup PO Lines window opens, listing the amounts from the purchase order. You'll see the job number, task, description, and cost amount for each line item. Double-clicking on a line item copies it onto the A/P invoice automatically.

If you write purchase orders, A/P invoices can reconcile your commitments automatically as they’re added. When you enter the invoice’s PO number and line number, details from the purchase order -- vendor, terms, job, task, and amount -- are copied to the invoice. The line number is important, since it matches up the right PO line item with the vendor’s invoice. This saves time, plus makes your job costing more accurate. Also, you’ll see at a glance if the vendor is billing you for more than you authorized on the purchase order. Insertion orders are handled like purchase orders.