Close Year

Clients & Profits supports two simultaneous fiscal years, so there’s no real sense of urgency about year-end closing. The year can be closed well into the next fiscal year. Throughout that time you can enter data into both the current year and last year, then print financial statements for any accounting period.

Closing The Year

Closing the year in Clients & Profits is extremely important and should be done sometime after

the end of your first fiscal year.

Clients & Profits supports two simultaneous fiscal years (for a total of 24 accounting periods),

so there’s no real sense of urgency about year-end closing. The year can be closed well into the

next fiscal year. Throughout that time you can enter data into both the current year and last

year, then print financial statements for any accounting period.

Once in the new fiscal year, you should run the Close Year tool as soon as you’ve made any

remaining adjusting entries. Closing is performed by a special tool that prepares your database

for the next year’s accounting work. Closing the year does not affect job tickets, time sheets,

accounts payable invoices, purchase orders, client invoices, payments, or checks in the

checkbook. Instead, closing only resets the General Ledger.

You can’t enter accounting data into a year that is closed: Once an accounting year is closed,

its journal entries are permanently removed from the current general ledger in preparation for

the new year. Closing the year removes the journal entries from periods 1-12. It then shifts

periods 13-24 to the corresponding periods of 1-12. Closing the year gives you 12 new accounting

periods to post accounting transactions into, for a total of 24 periods.

Users do not have to logout of Clients & Profits while the year is being closed, but they should

not add or post any new time entries, accounts payable invoices, client billings, checks, client

payments, deposits, or general ledger entries.

Pre-Close Year Checklist:

1 Add and post any adjusting entries into the year being closed. Entries such

as accumulated

depreciation, accrued interest, and adjusting entries you received from your tax preparer.

2 Post all unposted accounting items. Look for unposted items by choosing

Proof/Post from

Accounts Payable, Checkbook, Billing: Accounts Receivable, Client Payments, and the General

Ledger. Once the year is closed you can no longer make entries into the periods that were part

of the closed year.

3 Make sure that you have completed the recommended monthly period closing

procedures for the

year being closed.

4 Print a balance sheet for Period 12 and verify that the Suspense account has

a zero balance.

The Suspense account is used as a default G/L account if you add a transaction without a dGL or

cGL account. Printing a year to date detailed G/L report for the Suspense account will show any

transactions that posted to the Suspense account. Adjustments to the Suspense account

transactions can not be made after the year is closed if the transactions are in periods 1-12.

Print this report from Snapshots > Financials > Detailed G/L.

5 Review your Period 12 financial statements and check all account balances for

any errors you

might have overlooked. If you find something that should be corrected use the Clients & Profits

Auditor tool, to help locate and fix any errors. The Auditor tool is located in

Accounting>General Ledger.

6 Review the Client Account Aging and Vendor Account Aging reports for any

issues that need to

be resolved. For example, client invoices that will not be paid and should be written off with a

Write-off client payment; and vendor invoices that will not be paid and can be removed using a

vendor credit added from the Checkbook feature.

7 Print the year end financial reports for the year being closed as PDF files

(and hard copies

as well if needed).

Recommended reports:

- Balance Sheet

- Income Statement

- Trial Balance

- Detailed General Ledger

- Audit Trail (account history)

- General Ledger Journals: G/L, A/P, A/R, Checks, Payments

Also consider:

- Client Account Aging and Vendor Account Aging reports for Period 12

- Client P&L

- Budget vs Actual Reports

- Comparative financial reports

- Other financial reports you may use

Once the year is closed financial statements, general ledger journals, audit trails, and general ledger account detail can no longer be printed. You may need to refer to a previous year’s journal entries some time in the future, so having a permanent (and easily accessible) backup as PDF files or hard copies is handy.

8 If you are using the G/L Reconciliation Tool to reconcile accounts make sure you have reconciled the accounts through period 12.

The Retained Earnings Account

The Retained Earnings account keeps track of your net income/loss

from year to year. To close the year, you must have a Retained Earnings account.

You’ll be prompted to enter the Retained Earnings account, which must be an equity account, when

closing

the year. Clients & Profits calculates the agency’s net income by subtracting job costs and

overhead expenses from total income. The amount of your profit is then posted to retained

earnings, an equity (or “net worth”) account. This is the same as manual entries which close

income, costs, and expenses into retained earnings -- it’s just automated. Clients & Profits

will prompt you if the account does not exist.

Retained Earnings is a separate Equity account,

and is not the same as the Year-to-Date Profit account 999999.00

Online Archive Database

The Clients & Profits Close Year procedure will allow you to create an online archive of your

pre-closed database.

This feature will make a backup of your pre-closed database and enable a single user to

login view/print financial reports and ledger entries for the closed year.

These steps have been outlined below to help you get ready.

To Close The Year

Before closing the year, you’ll want to make sure you are in balance and there isn’t anything

listed in on your

main auditor reports for example, the Out of Balance Checker and the Account Totals Checker.

You will want to print out all of your important financials like the your Balance Sheet,

Trial Balance, Income Statement, Detailed GL are some examples and any other report that is

important to your company as a PDF or other type of copy.

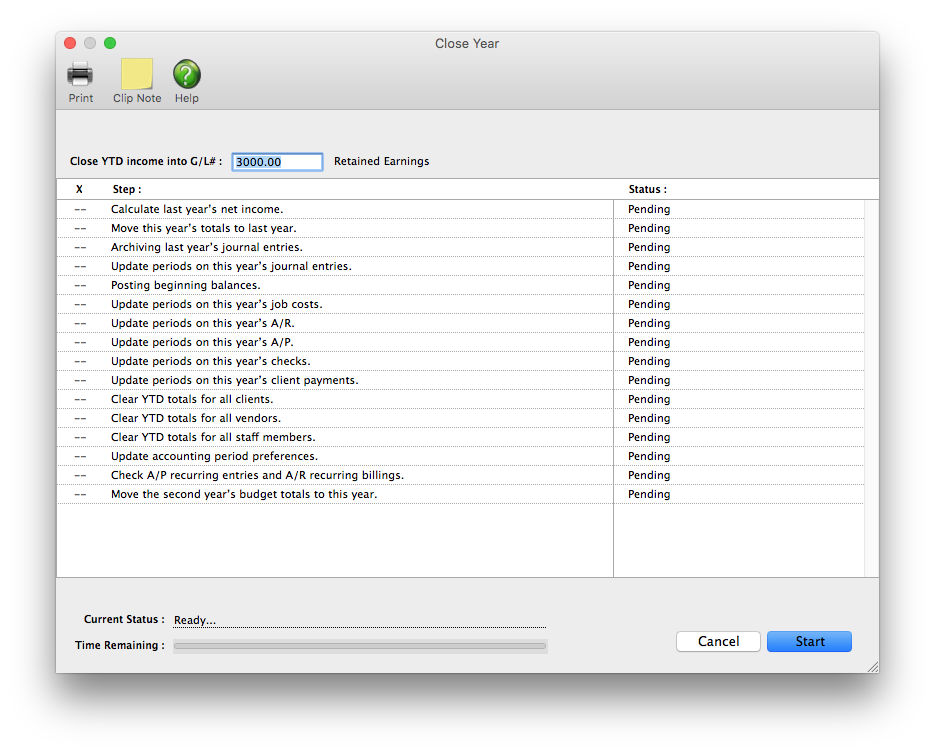

1 Choose Accounting > General Ledger, then click on G/L Tools > Close Year.

2 Enter your Retained Earnings account if it is not already filled in.

The Retained Earnings account keeps track of your net income/loss from year to year. To close

the year, you must have

a Retained Earnings account.

3 Click OK to acknowledge that you are ready to close periods 1-12 or Cancel to close at

a later time.

4 The next prompt enables you to take advantage of the online archive feature for an

Annual Fee. This feature will make a backup of your pre-closed database and enable a single user

to login view/print financial reports and ledger entries for the closed year. This fee also

includes all backups to this database in subsequent years.

Select Yes to create an online archive. No to decline. Our sales team will follow up with you

with instructions on how to login into the archive. The archive copy process will start and

you’ll be able to track of it’s progress shown in the next two steps.

If you have any questions about the online archive copy made here feel free to contact support

(1-800-521-2166) during our regular business hours (Monday - Friday from 7:00am - 5:00pm PT).

5 Next, confirm the year to be closed. Please confirm the last two digit of the year to

be closed. Then click OK.

6 Step one of the copy process creates your archive database.

Step two backs up your data.

Lastly, you will be prompted to Close the year. Clicking Yes will start the close year procedure

and this is the last chance that you’ll have available to you to cancel by clicking No.

7 From the Clients & Profits preferences window review your accounting periods, current

accounting period, and first day of your fiscal year.

8 Confirm your current financials to verify that the prior year’s ending balances were

correctly transferred during the close year process.

- Compare the balance sheet for Period 12, (that you printed before the year was closed) to the Trial Balance for Period 1, after you closed the year. The Period 12 balance sheet account balances for Asset and Liability accounts should match the Beginning Balances for Period 1 on the trial balance.

- The Retained Earnings account beginning balance will vary by the amount of the Net Earnings for the year closed. There should be no beginning balance amounts for any Income, Job Cost, Expense, Other Income, or Other Expense accounts

© 2026 Clients & Profits, Inc.